I use Quicken to manage my money. It’s old school money management. I don’t use online-only services like Empower (formerly Personal Capital).

Are you surprised? Is Quicken Worth it? Let’s look at what I like and dislike about Quicken.

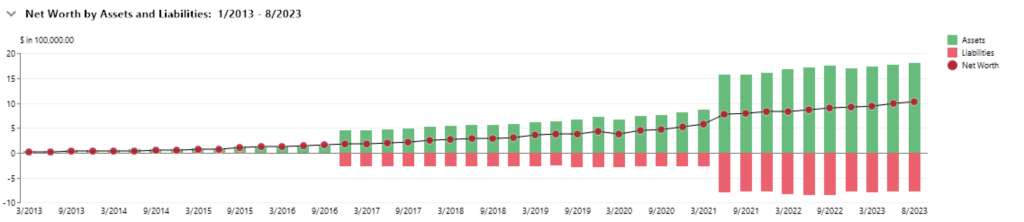

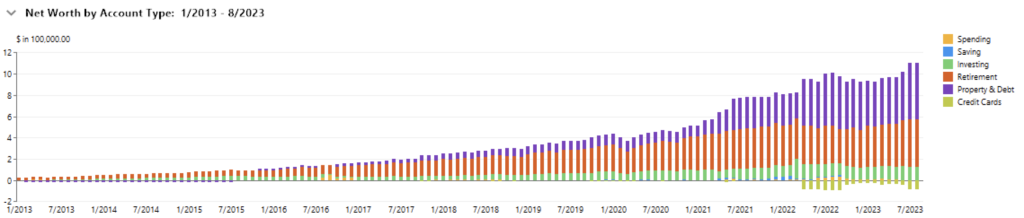

Positive: Net Worth Tracking in Quicken 🤑

Quicken is capable enough to track ALL my finances and give me an accurate report of my Net Worth. Every time I open Quicken, I see my Net Worth growth. This is motivating and rewarding because every time I open Quicken, I usually see my Net Worth has increased since last I looked.

Quicken can track nearly every account automatically by pulling transactions from banks and brokerages. There are a few exceptions that come to mind that I have to reconcile manually. Fundrise is and Tradier are examples top of mind where I have to reconcile by hand every month.

The screenshot below is straight out of Quicken. And I publish my Net Worth for motivational and education purposes.

Negative: Performance Could be Better 🏃♂️

One gripe I have with Quicken is how SLOW it can be. Sometimes it performs like a turtle 🐢 or a relic from the 1980s and 1990s. When I run bank updates to pull recent transactions, this process takes 5-10 minutes to complete. It’s one of those old-school tasks where I start it and then have time to go make a cup of coffee first.

Quicken’s official “solution” to this problem is to archive old transactions. I do not want to do that because it adds complexity to the accounts. Basically, Quicken creates hidden accounts with “archive” appended and moves transactions to that account. This is far from ideal.

Positive: Reporting in Quicken

The power of Reporting in Quicken is fantastic. I can slice and dice my numbers to my heart’s content. Need to see cash flow for my LLC? Yes, I can do that. Look at where my money is going on my rentals? Yes, can do! Need to see if I’m on-track to receive credit card signup bonuses? Yep, Quicken can do a report for that. How about generate a cost basis report for a property? Yep!

Reporting power helps paint a picture with data to better understand where my money is coming in and going out to. Welcome to Finance!

Negative: Subscription Cost is High 💰

Gone are the days when I could buy computer software and keep using it for years and only buy the next version every 5 years or so. Annual Recurring Revenue (ARR) is the new HOTness that a lot of software companies have been moving to. And Quicken is no exception to this. Quicken changed to an annual subscription fee a few years ago and it is extraordinarily costly compared to the previous pricing. Quickens new owner who happens to be an investment group, are milking the product. However, having said that I do see stead improvements and updates being made to Quicken. Much needed improvement from the days of ownership by Intuit.

Verdict: Is Quicken Worth It ⚖️

Yes! At least for me and at least for now. I would rather not pay upwards of $120 every year for this software, but the reality is that equates to less income than half a day’s work. It would take me far more than a half day to rebuild my financial tracking in some other system. My time is worth more to me. And so, I grit my teeth and pay for this subscription service. At least for now.

You can help me create more passive income by using this link to buy Quicken with my affiliate link if you choose to try Quicken.

Leave a Reply