This is my second update on the Ultiamate Asset Allocation Strategy. Just to be clear, this is MY allocation strategy and I make no guarantees about how this will work, and I am not a financial advisor and recommending that you adopt this. With that legal crap out of the way, let’s talk!

What’s New: Options Wheeling

In the last update August 2023, I mentioned that i had sold off all my bond indexes. With all of the cash that freed up, I began spinning the Options Wheel strategy on that cash.

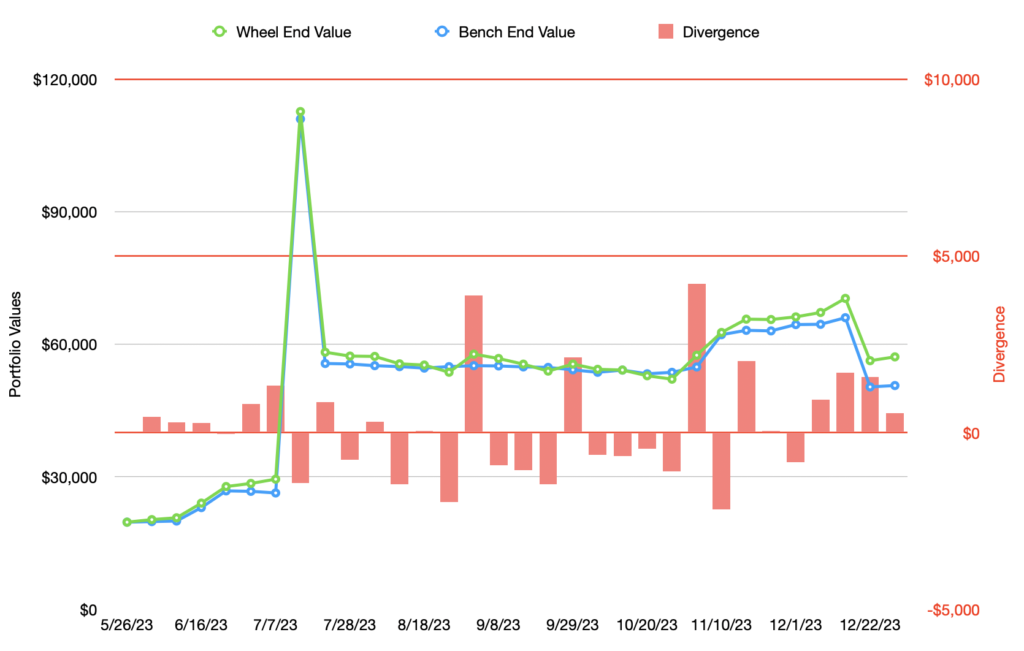

This graph shows off how that decision has paid off in the past six+ months. I made the right decision to liquidate and allocate that money toward my Options Wheeling. I’m above the bond index that I’m using: FXNAX.

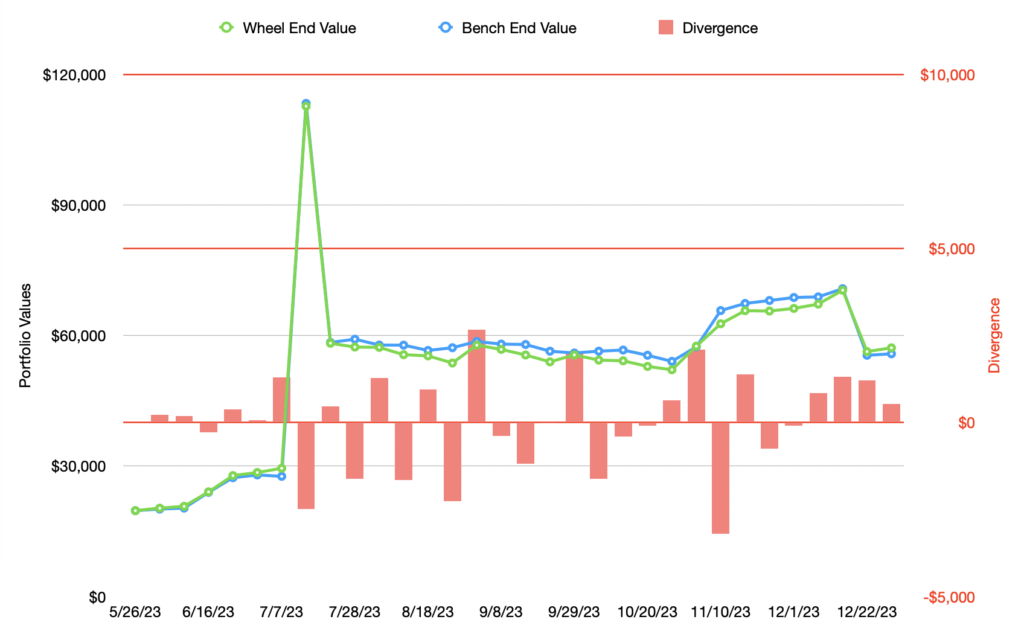

But what if I had just taken that cash and thrown it into an index fund based on the S&P 500? Here’s the graph with that comparison:

As you can see, I performed better than the bond index, which is excellent! However, my Options trading trailed the performance of the S&P 500 by a close margin up until December when my options trading took a turn for the better. I attribute this turn toward the year-end market rally which allowed the majority of my options to expire worthless while I collected on premium.

I still want to write up a detailed article on my Options Wheel trading and hope to get to that this year. It’s on my Todo list!

The Big Picture

All in all, the income from Options trading is the only new and changed thing in my allocation strategy. Otherwise, I’m still split about the same as I talked about a half year ago, so I suggest go back to that post to see my current allocations which have not changed substantially other than my exit from bond index funds.

Until the next asset allocation update which will probably be around August 2024. Cheers!

Leave a Reply